Australian foundation Investment Company (AFIC) moves from Branch specific Banking to Branchless Banking with SOL Banking

The Bankers at AFIC Bank believed in Branchless Banking for managing 8 of their branches but did not have the toolset to implement it and get started. The main system used by them was a DOS based version which was inflexible, branch specific and not user friendly. When the opportunity came to evaluate other online banking solutions, they jumped on it and soon chose SOL Banking.

About AFIC

Australian Foundation Investment Company (AFIC) specialises in investing in Australian equities. They have been investing in Australian companies for over 80 years and are Australia’s largest listed investment company with a market capitalisation of over $6 billion. They aim to provide shareholders with attractive investment returns through access to a steady stream of fully franked dividends and medium to long term capital growth at a very low cost.

The Challenges

“Last Generation” Banking System limited AFIC’s chances to go global

Metui Kalopung, IT Administrator for AFIC Bank, was frustrated by how the limitations of the DOS based Banking system used by the Bank limited their ability to execute their strategies. The main system they used to support AFIC Bank was found to be inflexible, branch specific and not user friendly. “You either had an extremely limited set of tools to work with or you had to go hire a custom developer to implement a basic functionality change. Moreover, you never know what the other Bank branches are doing... It became something I dreaded logging into,” says Kalopung.

The whole team believed in Online Banking Solution – something which is secure and is easy to adapt, but didn’t have the right toolset to implement it. When the opportunity came up to evaluate other Banking software options, Kalopung jumped on it.

The Solution

Kalopung required a system that would grow with the business; this eliminated many vendors when combined with his desire for software that is easy-to-use. His decision came down to SOL Banking and a Local Vendor. “We felt that [Local Vendor was] a new and improved version of Banking solution but that’s only a part of what we were trying to implement with Online Banking... We chose SOL Banking because we felt it was the most complete solution available in the market, and more importantly, would continue to innovate in the Banking sector because someone at SOL Banking is always asking: how does that fit into Online Banking?” Kalopung once said.

SOL Banking system faced another challenge during implementation – migration of old system data into the new online platform and business requirement related changes which were pending due to non-availability of a Branchless system. Both challenges were undertaken and the complete solution was delivered to AFIC Bank in a record time of 45 days. An audit was conducted and the parallel run with the existing system was conducted for the next 3 months.

AFIC Bank finally shifted over to SOL Banking solution completely in October 2015 and since then it has been a win-win situation for both Organizations. Since SOL Banking solution is evolving software, all changes done after the delivery get automatically passed over to AFIC Bank under the AMC.

Results

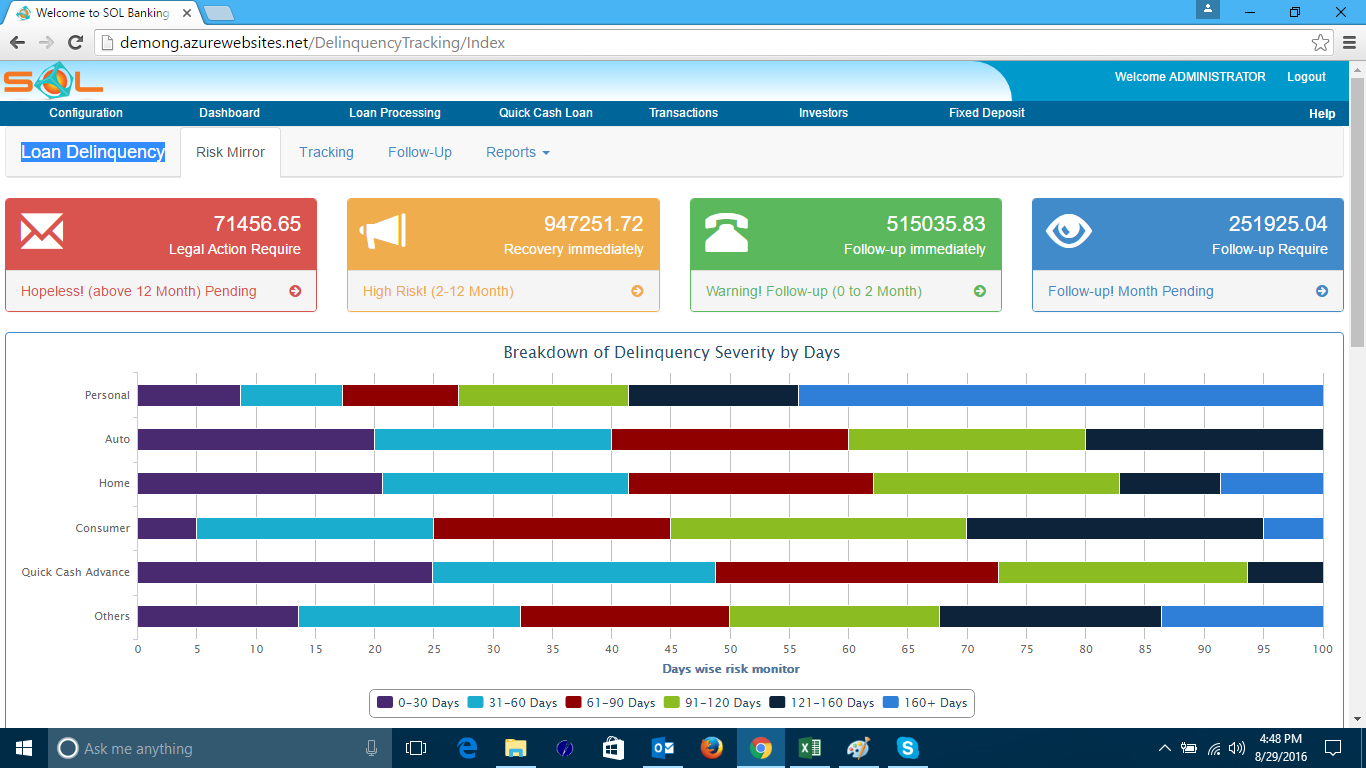

Kalopung is a stickler for analytics and has the metrics to show that AFIC’s decision to take an online Banking solution approach and use SOL Banking solution has paid off. Year-over-year, he has seen 60% increase in new customer enrollment for KYC and Account Opening, a 36% increase in Loan requests, and a 110% increase in Loan sanctions after verification – across branches.

Most of all, Kalopung finds having an all-in-one Banking platform which helps him to execute his Branchless Banking operations more quickly. "Part of being successful at handling multiple Customer requests is to be fast and agile and have analytics… too many branch-specific systems just create hurdles for you. Having one integrated system helps me manage Customer queue faster and address their needs."

Call to Action

QUESTIONS?

Call us and speak with an Inbound Markating Specialist to answer any question you have.

Request A Demo

Schedule a demo to talk an Inbound Markating Specialist about your specific needs.